Imf Venezuela Hyperinflation

hyperinflation venezuela wallpaperBut according to the IMF Venezuelas inflation rate is going to hit 1000000 by the end of 2018. 2021 International Monetary Fund.

Venezuela S Hyperinflation Drags On For A Near Record 36 Months

Venezuela S Hyperinflation Drags On For A Near Record 36 Months

Today 73118 the annual inflation rate for Venezuela sits at 33151.

Imf venezuela hyperinflation. Venezuela has the dubious distinction of having the worlds highest level of inflation. Reuters - Venezuelas inflation rate will reach 10 million percent next year the International Monetary Fund IMF said on Tuesday in a report forecasting that one of the worst hyperinflationary. Venezuela is facing hyperinflation due to excessive amounts of printing of the Venezuelan Bolivar.

According to the International Monetary Fund IMF Venezuelas estimated inflation rate in 2017 was 10875. Venezuela began experiencing continuous and uninterrupted inflation in 1983 with double-digit annual inflation ratesInflation rates became the highest in the world in 2014 under Nicolás Maduro and continued to increase in the following. The economy of the oil-rich nation has shrunk by more than half since 2013 according to IMF data.

In May 2019 the Central Bank of Venezuela released economic data for the first time since 2015. The last Article IV Executive Board Consultation was on September 13 2004. Venezuelas hyperinflation which has been roaring away since November 2016 is depicted in the chart below.

Meanwhile hyperinflation continues unabated with monthly price increases of about 100 percent rivaling other historic hyperinflation episodes. The IMF said that. Venezuelas bout of hyperinflation began on November 13 2016 when the monthly inflation rate first breached the 50 per month hyperinflation threshold.

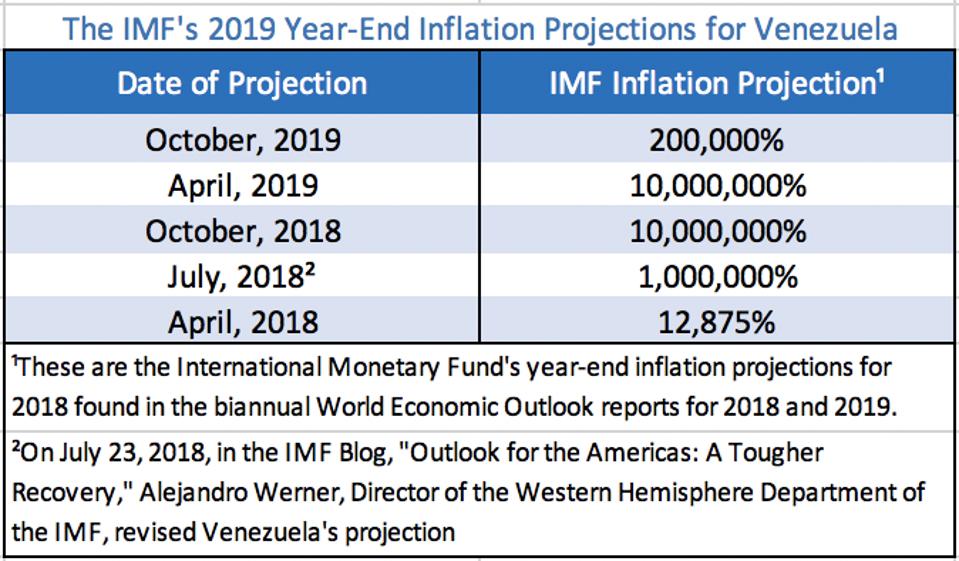

Venezuelas bout of hyperinflation began on November 13 2016 when the monthly inflation rate first breached the 50 per month hyperinflation threshold. The biggest problem facing Venezuelans in their day-to-day lives is hyperinflation. In April 2019 the International Monetary Fund estimated that inflation would reach 10000000 by the end of 2019.

Venezuelas hyperinflation rate increased from 902 percent to 10 million percent since 2018 according to the International Monetary Fund though it is expected to decline to back below 1 million. Listed below are items related to República Bolivariana de Venezuela. According to a study by the opposition-controlled National Assembly the annual inflation rate reached 1300000.

Today Venezuelas monthly inflation rate. Today Venezuelas monthly inflation rate. Hyperinflation is the term used to describe prices spiralling out of control accompanied by plunging currency values leading consumers to require wheelbarrows full of money to buy everyday.

Hyperinflation in Venezuela is the currency instability in Venezuela that began in 2016 during the countrys ongoing socioeconomic and political crisis. Facing these harsh living and economic conditions migrants are fleeing Venezuela and settling in neighboring countries. Hyperinflation is commonly defined as a month-to-month inflation rate above 50 percent.

In July 2018 hyperinflation in Venezuela was sitting at 33151 the 23rd most severe episode of hyperinflation in history. Both the AN and BCV despite differing slightly in their numbers coincide that for the past three months Venezuela appears to moving out of hyperinflation which the country had been suffering from since late 2017. Colombia has received the largest share followed by Peru Ecuador Chile and Brazil.

Venezuela inflation set to reach 1 million percent IMF says Venezuelas real GDP is expected to shrink by 18 percent in 2018 marking five consecutive years of declining growth. The annual inflation rate for Venezuela is 60324 and the monthly rate is 94 according to Forbes calculated in October of 2018. Hyperinflation and shortages of food and other necessities have also driven at least 3 million Venezuelans out of their country according to the United Nations.

The International Monetary Fund sees Venezuelan inflation spiraling to 13000 percent this year as the crisis-torn nation prints money to tackle fiscal deficits and confidence in its currency.