Chapter 35 Benefits Taxable

benefits taxable wallpaperI just got my second check and it dropped to only 550. Neither of these benefits is taxable and you do not report them on your tax return.

It brings significant changes to Veterans education benefits.

Chapter 35 benefits taxable. The Survivors and Dependents Educational Assistance DEA program offers education and training to qualified dependents of Veterans who are permanently and totally disabled because of a service-related condition or who died while on. Neither of these benefits is taxable and you dont report them on your tax return. The following is taken directly from the IRS website IRS Information for Veterans.

No your VA Benefits are not taxable income. Olmery Veterans Educational Assistance Act also known as the Forever GI ill was signed into law on Aug. Incapacity Benefit except for the first 28 weeks higher rate and those who were receiving the former Invalidity Benefit at 12 April 1995 for the same incapacity long term.

If you serve or served in the military and are receiving Department of Veterans Affairs VA education benefits the IRS excludes this income from taxation. The Marine Gunnery Sergeant John David Fry Scholarship Fry Scholarship is for children and spouses of service members who died in the line of duty after September 10 2001. Publication 970 Tax Benefits for Education the authoritative source for all education tax matters covers this tax exclusionYou can learn more about Veterans Benefits in chapter 1.

Youll need to apply. Chapter 4 30 December 2019 Guidance Non-taxable payments and benefits 480. You have returned to college and are receiving two education benefits under the latest GI Bill.

Employment and Support Allowance contributory and youth. A 1534 monthly basic housing allowance BAH that is directly deposited to your checking account and 3840 paid directly to your college for tuition. Chapter 5 30 December 2019.

Taxable benefits and facilities 480. The Chapter 35 benefit must also be reported as education benefits income for the dependent child on the Federal FAFSA form when applying for financial aid through the federal and state government. Spouse of veteran rated permanently and totally disabled by the VA.

I thought Id gotten the 3k because Im supposed to be getting a years worth of back pay because a year ago is actually when my dad was first classified as a fully disabled veteran and it gave me to option when I first filled out the paper to put that date down. History of the GI Bill The original GI Bill officially known as the Servicemens Readjustment Act was passed in 1944 despite it being highly controversial. You also want to claim an American opportunity credit on your return.

The benefits can add up to thousands of nontaxable dollars that you do not have to report as income on your individual income tax return Form 1040. However when filing a tax return you are asked about veteran benefits. Bereavement Allowance previously Widows pension.

Andrea Chapter 35 benefits are not taxable but remember that youll not be able to take an educational credit Hope or Lifetime on your 1040 nor can you add the amount reported by the school to the IRS IRS Form 1098-T to your itemized deductions because the money you receive from the VA DEA Program must be counted against these amounts -- and you can only use amounts you paid in excess of the VA payments. VA Chapter 35 Benefits By Eric Duncan Survivors and Dependents Educational Assistance is a program managed by the Department of Veterans Affairs that provides up to 45 months of educational benefits to children and spouses of disabled veterans and surviving family members of deceased veterans. In particular some of the payments which are considered disability benefits include.

Chapter 35 Benefits Dependents Education Assistance is a monthly education benefit for spouses surviving spouses and children of a permanently and totally disabled veteran. Do not include disability benefits you receive from the VA in your gross income. I just started getting chapter 35 benefits and my first month I got 3000.

Benefits under a dependent-care assistance program Additionally education and training benefits provided to veterans under the GI Bill are not taxable income. First add up all taxable income - including any taxable state benefits. I understand that Chapter 35 benefits are tax free.

The Chapter 35 benefit is non-taxable income for the dependent child on their tax return IF heshe is required to file a tax return. Apply for VA education benefits Chapter 35 benefits. Its possible to work out if Income Tax needs to be paid by following just three steps as govuk advise.

You may be eligible for Chapter 35 benefits if you fall under one of the following categories. The following social security benefits and pensions are taxable. Survivors and Dependents Education Assistance DEA is an education benefit for eligible spouses and children of certain Veterans.

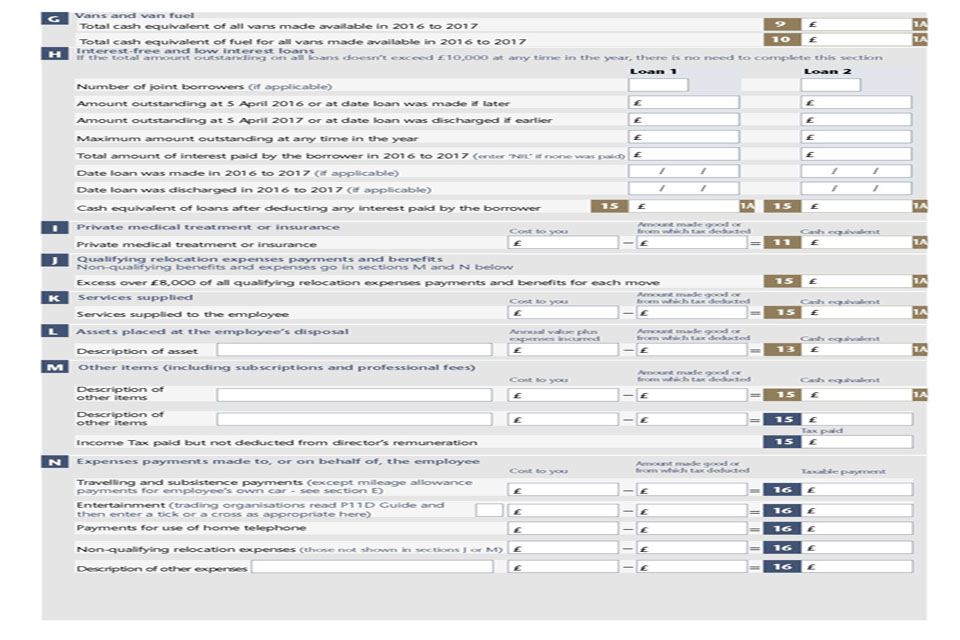

Guidance on how to report expenses and benefits provided to employees or directors explaining which benefits can be payrolled how to work out the cash equivalent salary sacrifice pay periods situations where the employee pays towards the cost of the benefit and where an employees tax is more than 50 of their pay. State benefits that are taxable The most common benefits that you pay Income Tax on are. 1 a 1534 monthly basic housing allowance BHA that is directly deposited to your checking account and 2 3840 paid directly to your college for tuition.

Read below for a summary of the po. While filing my taxes I indicated my daughter I am claiming her was a full time student at a university.

Https Researchbriefings Files Parliament Uk Documents Cbp 8631 Cbp 8631 Pdf

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

2017 Class 1a National Insurance Contributions On Benefits In Kind Gov Uk

Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 825306 Germany Facebook Qanda 6 August 2019 Pdf

Download Employee Base Salary Increase Rate Calculator Excel Template Exceldatapro Salary Increase Metric Compensation

Download Employee Base Salary Increase Rate Calculator Excel Template Exceldatapro Salary Increase Metric Compensation

How Employment Income Is Taxed Concept Of General Earnings Legal Guidance Lexisnexis

How Employment Income Is Taxed Concept Of General Earnings Legal Guidance Lexisnexis

Https Www 4cmr Group Cam Ac Uk Filecab Redd Law Project 21040813 20wp 20legal 20aspects 20of 20benefit 20sharing 20for 20redd Pdf

To Soar In 2021 The Americas Remained The Most Active

To Soar In 2021 The Americas Remained The Most Active

Https Www Tax Org Uk System Files Force June 202017 20paper 203 01 20 28candidate 20script 29 Pdf Download 1

Http Www Worcestershire Gov Uk Worcestershirepensionfund Download Downloads Id 126 Full Guide To Lgps May 2018 Pdf

Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 838130 Taxation And Life Events Oct 2019 Pdf

The Relationship Between Price And Quantity Supplied Relationship Price Supply

The Relationship Between Price And Quantity Supplied Relationship Price Supply

Https Www Accaglobal Com Content Dam Acca Global Technical Fact Finance Act 2019 Summary 20 0319 Pdf

Creating A Tangible Separation From Work When We Retire Life Hacks To Make Life Feel Different After Retirement When Y Life Life Hacks Retirement Finances

Creating A Tangible Separation From Work When We Retire Life Hacks To Make Life Feel Different After Retirement When Y Life Life Hacks Retirement Finances

If You Are Involved In Any Trade Business In India Then It Is Important That You Understand The Import Duty India Import Duty Custom Indian Customs Duties

If You Are Involved In Any Trade Business In India Then It Is Important That You Understand The Import Duty India Import Duty Custom Indian Customs Duties

How To Write A Corporate Sponsorship Proposal Get Corporate Sponsorship Sponsorship Proposal Sponsorship Letter Charity Work Ideas

How To Write A Corporate Sponsorship Proposal Get Corporate Sponsorship Sponsorship Proposal Sponsorship Letter Charity Work Ideas

Can I Protect My Retirement Income And 401 K From Taxes Charles Schwab Retirement Income Income Retirement

Can I Protect My Retirement Income And 401 K From Taxes Charles Schwab Retirement Income Income Retirement

Https Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 843521 Summary Of Facebook Q A 21 October 2019 Pdf

Http Www Ifs Org Uk Uploads Mirrleesreview Dimensions Ch9 Pdf

Https Www Ofgem Gov Uk Ofgem Publications 145614

Mercy Home Alone At Mercy Old Tesson Real Estate Contract Assisted Living Facility Litigation Lawyer

Mercy Home Alone At Mercy Old Tesson Real Estate Contract Assisted Living Facility Litigation Lawyer