Imf Swap Turkey

swap turkey wallpaperSeeking an IMF bailout would be a reversal for. Yet Turkish President Recep Tayyip Erdogan is.

Dollar Liquidity Measures Leave Some Countries Out In The Cold Financial Times

Dollar Liquidity Measures Leave Some Countries Out In The Cold Financial Times

The agreement with Qatar at the height of a currency rout in 2018 provided 3 billion in inflows from the Gulf state.

Imf swap turkey. Turkeys banks have borrowed from abroad to provide foreign exchange that they swap into lirawhether in the market or now with the Central Bank of the Republic of Turkey. Some observers tend to attribute the spurning of Turkey to diplomatic frictions with Washington but harsh economic realities stand out as the essential reason. Turkeys overleveraged nonfinancial companies already drowning in foreign exchange liabilities totaling some 300 billion continue to pay the price.

Foreign investors sold a net 795mn of Borsa Istanbul equities in the three weeks from January 15 to February 5 central bank data showed on February 11. In as much as markets are taking a hedged on Ankara breaking its habitual distaste of IMF the bar for either a stand-by or Fed-IMF swap lines remain extremely high 11 April 2020 Turkey currency stepped back from the abyss gaining ca 15 for the week against the American as other financial markets rejoiced too thanks to a Bloomberg article which claims Ankara may consider signing a stand-by deal with IMF. The Fed extended dollar swap lines to several countries in March but it appears unlikely to add Turkey.

Turkey has clinched swap deals with China and Qatar and the sum obtained through those deals has been announced as 16 billion. Turkey has currency swap facilities worth 17 billion with China and 5 billion with Qatar. Turkey signed swap agreements with the central banks of Qatar and China.

About BIS The BISs mission is to serve central banks in their pursuit of monetary and financial stability to foster international cooperation in those areas and to act as a bank for central banks. Instead it hopes to. 903 12 446 5007 Ben Kelmanson Senior Resident Representative Ben Kelmanson took up the position of Senior Resident Representative in Turkey in August 2018.

Either you are going to get a swap line from the Fed getting dollars in return of Turkish lira or an IMF loan - Baris Soydan economist Albayrak the economy minister reminded in the interview. Borsa Istanbuls benchmark BIST-100 index moved. Last months application to the Fed yielded no results as the US.

To this end one of the most important options for Turkey is to coordinate with the International Monetary Fund or negotiate a currency swap line with the US. Despite the Turkish lira hitting a record low against the dollar and euro Ankara has so far resisted asking for help from the International Monetary Fund IMF. The last time the IMF bailed out Turkey in 2001 a whole generation of Turkeys political leaders lost power and paved the way for Erdogans ascent.

Turkey had no need for a standby agreement Ibrahim Kalin told the broadcaster CNN Turk. The IMF office in Ankara follows economic developments and policies in Turkey liaises between the Turkish authorities and the IMF staff in Washington and coordinates IMF technical assistance. Questions linger over how much foreign support Turkish officials will seek amid the pandemic as political leaders maintain negotiations with the International Monetary Fund are off the table.

Turkey cannot afford to handle COVID-19 crisis without external borrowing study says. Mr Erdogan inherited an IMF programme when he swept to power in 2002 on the back of a severe financial. The study said that although a swap agreement with the US.

Resident Representative for Turkey Ben Kelmanson Senior Resident Representative. Federal Reserve as well as the IMF could help Ankara to battle the crisis the arrangement of a swap line alone would likely be. In the same period foreign players bought a net 593mn of Turkish domestic government bonds.

Turkey is in dire need of a source of external funding granted through a credible international institution in order to combat the economic impact of the coronavirus according to a research of five Turkish economists. Ulgen said the Qatar swap line will help stem inflationary pressure on Turkeys lira in the short-to-medium term but authorities in Ankara will continue to seek ways to reel back the economic slowdown in the months ahead. The last time the IMF bailed out Turkey in 2001 the financial crisis at the time wiped out a whole generation of Turkeys political leaders and paved the way for Erdogans ascent to power.

It is also a source of information about IMF views for the public local and foreign analysts investors academic and research institutions and Turkey. Federal Reserve and has discussed other funding options to mitigate fallout from. ANKARA Reuters - Turkey has held talks with the United States about possibly securing a swap line from the US.

Turkey sought a similar deal with the US Federal Reserve but to no avail even though the Fed offered swap lines to other emerging economies such as Brazil and Mexico. Central bank did not include Turkey among the 20 countries approved for its swap lines.

Is Imf An Option For Turkey Daily Sabah

Is Imf An Option For Turkey Daily Sabah

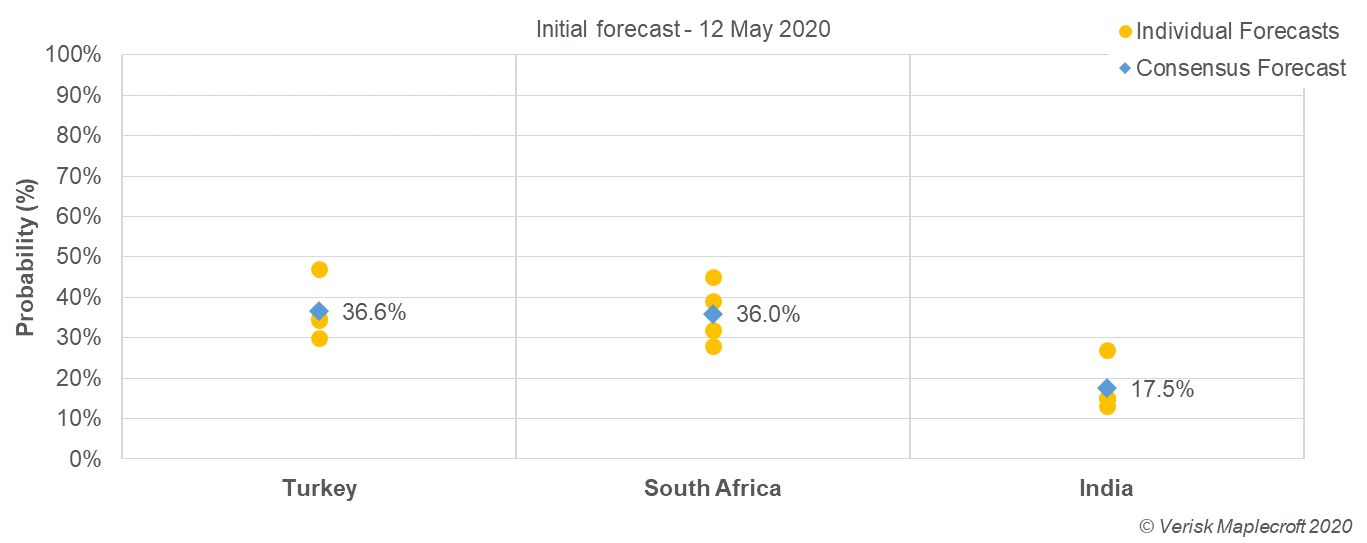

Are Turkey South Africa And India The Next Imf Bailout Contenders Maplecroft

Are Turkey South Africa And India The Next Imf Bailout Contenders Maplecroft

Https Www Imf Org External Pubs Ft Scr 2012 Cr12261 Pdf

Turkey In Swap Talks With G20 Members Finance Minister

Turkey In Swap Talks With G20 Members Finance Minister

Bne Intellinews Turkey Insight The Lira Has Belly Flopped And London It Is Your Fault

5 Use Of Foreign Exchange Swaps By Central Banks Instruments Of Monetary Management Issues And Country Experiences

5 Use Of Foreign Exchange Swaps By Central Banks Instruments Of Monetary Management Issues And Country Experiences

Https Www Imf Org External Pubs Ft Scr 2010 Cr10278 Pdf

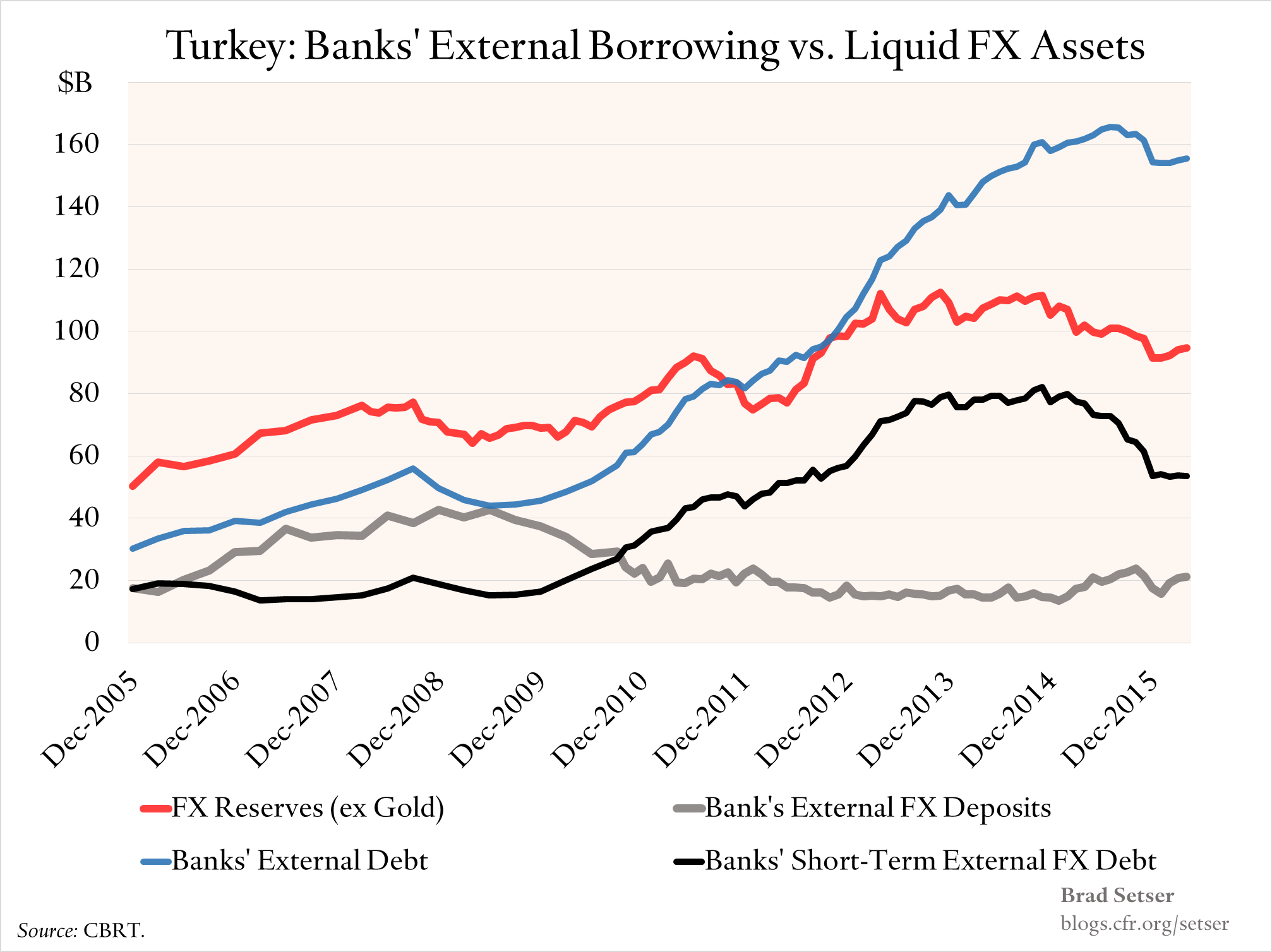

Turkey Could Use A Few More Reserves And A Somewhat Less Creative Banking System Council On Foreign Relations

Turkey Could Use A Few More Reserves And A Somewhat Less Creative Banking System Council On Foreign Relations

Taper Tantrum Or Tedium How U S Interest Rates Affect Financial Markets In Emerging Economies Imf Blog

Chapter 2 A New Look At The Role Of Sovereign Credit Default Swaps Global Financial Stability Report April 2013 Old Risks New Challenges

Chapter 2 A New Look At The Role Of Sovereign Credit Default Swaps Global Financial Stability Report April 2013 Old Risks New Challenges

Turkey Continues Swap Talks With Many Countries Officials Say Daily Sabah

Turkey Continues Swap Talks With Many Countries Officials Say Daily Sabah

Turkey Turkey Sixth Review And Inflation Consultation Under The Stand By Arrangement And Request For Waiver Of Nonobservance And Applicability Of Performance Criteria Staff Report Staff Supplement And Press Release On

Turkey Turkey Sixth Review And Inflation Consultation Under The Stand By Arrangement And Request For Waiver Of Nonobservance And Applicability Of Performance Criteria Staff Report Staff Supplement And Press Release On

The Imf Remains The Lender Of Last Resort Literally Chatham House International Affairs Think Tank

The Imf Remains The Lender Of Last Resort Literally Chatham House International Affairs Think Tank

Gulftimes Turkey Said To Seek Fx Swaps With G20 Members Including Us

Gulftimes Turkey Said To Seek Fx Swaps With G20 Members Including Us

Http Www Imf Org Media Files News Seminars 2017 The Future Of International Monetary System For Asia Presentation 1 2 Challenges And Reforms To The International Monetary System Ashx

Swap Talks Continue With Many Countries Turkey

Swap Talks Continue With Many Countries Turkey

How Many Reserves Does Turkey Need Some Thoughts On The Imf S Reserve Metric Council On Foreign Relations

How Many Reserves Does Turkey Need Some Thoughts On The Imf S Reserve Metric Council On Foreign Relations

Why Turkey S Ruling Akp Party S Coronavirus Plan Could Be A Disaster The National Interest

Why Turkey S Ruling Akp Party S Coronavirus Plan Could Be A Disaster The National Interest

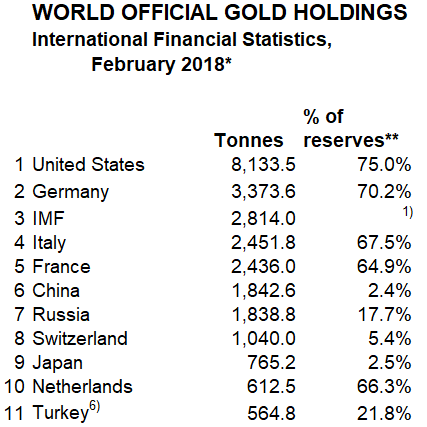

Why The World S Central Banks Hold Gold In Their Own Words

Why The World S Central Banks Hold Gold In Their Own Words

Turkey 5 Years Cds Source Investing Com 2 Internationally Accepted Download Scientific Diagram

Turkey 5 Years Cds Source Investing Com 2 Internationally Accepted Download Scientific Diagram