Education Tax Benefits 2019 South Africa

2019 africa wallpaperUnder current tax law applicable up to 28 February 2020 South African tax residents working abroad are entitled to a tax exemption from income earned abroad provided that theyre physically outside of South Africa for 183 days in aggregate during any 12-month period and during that 183-day period outside South Africa at least 60 days must be continuously spent outside SA. The most common reasons why employers business owners and their advisors have been reluctant to offer this to employees include.

An Employee S Guide To Understanding Your Irp5 Rsm South Africa Employee Guide To Your Irp5

An Employee S Guide To Understanding Your Irp5 Rsm South Africa Employee Guide To Your Irp5

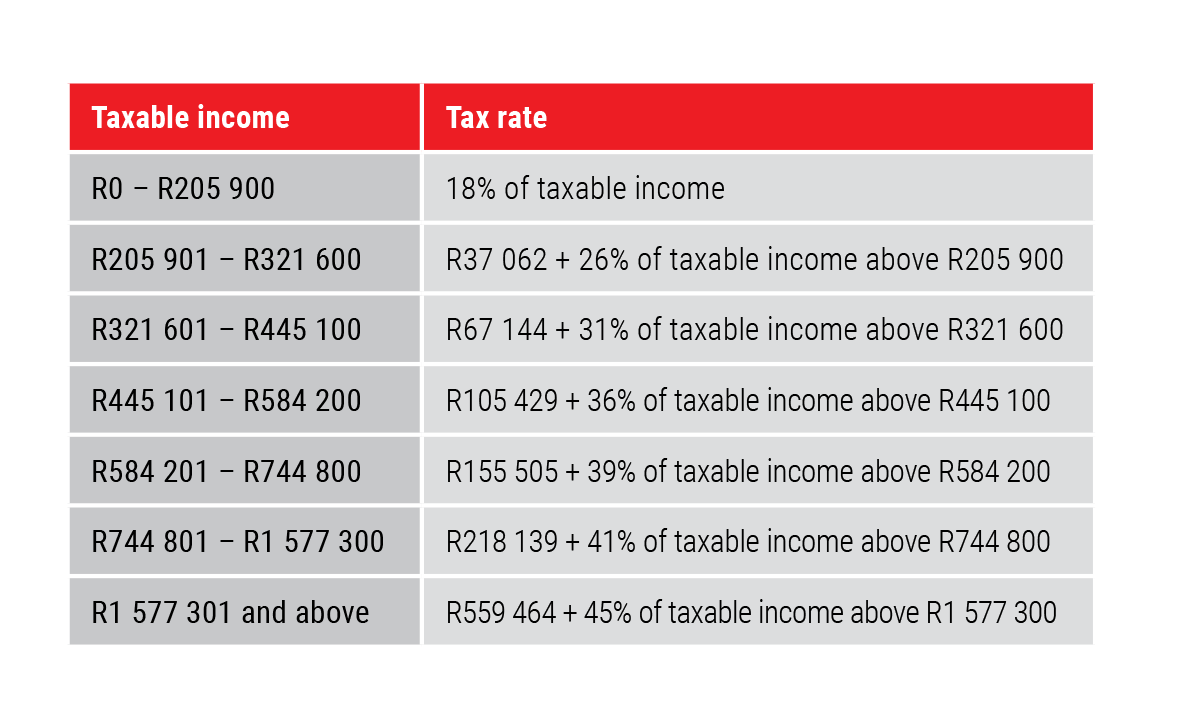

You are viewing the income tax rates thresholds and allowances for the 2019 Tax Year in South Africa.

Education tax benefits 2019 south africa. Like most countries South Africa has a progressive personal tax regime. The Department of Basic Education DBE is mandated to monitor the standards of education provision delivery and performance across South Africa annually or at other specified intervals to assess compliance with provisions of the Constitution of the Republic of South Africa of 1996 and national education policy. President Cyril Ramaphosa signed three Bills into law in January 2019 alone.

For qualifying employees the saving ranges between R3600 to R23400 per child per annum. The employee earns an annual salary of R390000 a bonus of R18000 and a housing subsidy of R8000. The South African Revenue Service SARS is the revenue service of the South African government.

Lived in South Africa for more than 91 days in each of the last five tax years and at least 915 days in total across those five years. Taxation Laws Amendment Act 20. Education Tax Benefit Grant South Africa.

On 25 April 2018 in Marshall vs. The employer does not operate a bursary scheme that is open to the general public. The South African Revenue Service SARS provides an annual planner for due dates for different taxes in South Africa.

During the last three months of 2018 and into January 2019 South Africa introduced a number of legislative changes that will have a direct impact on how payroll is processed in the country. Education in South Africa plays a significant role in society. Small business tax South Africa.

The trust in. The medical scheme fees tax credits for 20182019 he said. An employer grants a bursary of R24000 to each of the employees two children intended for their school education.

Basic Educaton Higher Education and Training Basic education. The harmonisation of the tax treatment of payments to South African retirement funds to ensure consistent treatment of the contributions irrespective of the. If you are lucky enough to be earning a salary above the highest tax bracket you will save 45 in tax on an extra rand saved in a retirement fund whether it be in the current tax year or at some.

Our tax rates put a heavier tax burden on those who should be able to afford it best those who earn the highest salaries. You can greatly reduce your tax liability by asking your employer to pay for your childs school or university education or for your own education. Commission for the South Africa Revenue Service the South African Constitutional Court upheld a decision of the Supreme Court of Appeal determining whether the business activities of a non-profit public benefit trust constituted a deemed supply of services and thus qualified to be zero rated under section 85 and 112 of the VAT Act.

Provided that such funds are registered in South Africa. March 26 2020 Handi Unagi Leave a comment Education. Spending priorities the need for a revolutionary contractionary fiscal policy south s.

The saving depends on the cost of school fees tax brackets and number of children. And Educational organisations ie. Trusts excluding special trusts in South Africa pay tax at a separate rate of 45.

Private and public schools higher learning institutions and non-profit organisation in the education industry share the responsibility with Government for the social and development needs of the country. This South African tax exemption is at risk due to questionable bursary schemes Staff Writer 2 June 2019 The ability for employees and business owners to pre-tax structure their relatives school. By restructuring his salary in terms of Section 101q the tax deduction would afford him an after-tax amount of R3 40464 in the tax year.

Four tax changes you need to know about in South Africa including your travel allowance claim. This would be calculated as follows. If you are looking for an alternative tax year please select one below.

Are a permanent or temporary resident of South Africa if you have South African citizenship or a South African residence permit you must pay taxes. 2016 - 2017 Tax Tables 2017 - 2018 Tax Tables 2019 - 2020 Tax Tables 2020 - 2021 Tax Tables. Also we offer free education in South Africa.

It was established by legislation to collect revenue and ensure compliance with tax law. Than a R350000 benefit should. The South African Revenue Service allows income.

South Africa is the most developed of all the African countries. The corporate tax rate in South Africa is a flat rate of 28 for all companies. However quality always comes at a cost.

Naturally we enjoy better educational resources than the rest of the continent and our higher learning institutions are ranked among the best. This is slightly below the average corporate tax rate for Africa overall which is 2845 and above the global average of 2418. Donations to certain approved public benefit organisations are allowed as deductions up to a maximum of 10 of taxable income.

Gold Price Movements In India 1990 2019 Gold Bond Gold Price Investment In India

Gold Price Movements In India 1990 2019 Gold Bond Gold Price Investment In India

Jamalife Helpers Global South Africa Compensation Plan Explained In Rands How To Plan Compensation South Africa

Jamalife Helpers Global South Africa Compensation Plan Explained In Rands How To Plan Compensation South Africa

Https Www Sars Gov Za Alldocs Opsdocs Guides Lapd Gen G01 20 20taxation 20in 20south 20africa Pdf

This Infographic Summarises The Budget Proposals Set Out In South African Finance Minister Tito Mboweni S National Budget Budgeting Content Infographic Speech

This Infographic Summarises The Budget Proposals Set Out In South African Finance Minister Tito Mboweni S National Budget Budgeting Content Infographic Speech

Retirement Annuities Is The Tax Refund Worth It

Retirement Annuities Is The Tax Refund Worth It

South Africa Booklet Country Study Project Unit Social Studies Projects Kindergarten Special Education Booklet

South Africa Booklet Country Study Project Unit Social Studies Projects Kindergarten Special Education Booklet

It S A Mezzz Merizing Monday And New Week Ahead Make The Best Of It Have A Fantastic Week And While You Are Education South African Celebrities Bring It On

It S A Mezzz Merizing Monday And New Week Ahead Make The Best Of It Have A Fantastic Week And While You Are Education South African Celebrities Bring It On

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

What Is Term Insurance Features Benefits Of Term Insurance Insurance Explained By Y Term Insurance Insurance Benefits Insurance

What Is Term Insurance Features Benefits Of Term Insurance Insurance Explained By Y Term Insurance Insurance Benefits Insurance

Several Proposed Us States Throughout History Maps Interestingmaps Interesting Illustrated Map U S States History

Several Proposed Us States Throughout History Maps Interestingmaps Interesting Illustrated Map U S States History

The Complete Guide To Corporate Tax In South Africa Expatica

The Complete Guide To Corporate Tax In South Africa Expatica

Gst Council Meet Starts Watch Out For Assessment Rate Around Gold New Wares A Meeting Of The Fifteent Essay Disadvantages Of Social Media Social Media Essay

Gst Council Meet Starts Watch Out For Assessment Rate Around Gold New Wares A Meeting Of The Fifteent Essay Disadvantages Of Social Media Social Media Essay

Hobo Day Tm For Executives Is Almost Here Join Us This Weekend 31 Aug 10am To 1 Sept 2019 10am Awareness Campaign Long Term Care Insurance How To Find Out

Hobo Day Tm For Executives Is Almost Here Join Us This Weekend 31 Aug 10am To 1 Sept 2019 10am Awareness Campaign Long Term Care Insurance How To Find Out

Allan Gray 2020 Budget Speech Update

Allan Gray 2020 Budget Speech Update

Let Us Take A Minute To Acknowledge And Say Thank You To A Person Persons In Your School Company Or How To Find Out Long Term Care Insurance Long Term Care

Let Us Take A Minute To Acknowledge And Say Thank You To A Person Persons In Your School Company Or How To Find Out Long Term Care Insurance Long Term Care

Tekkie Tax Benefits 32 Child Protection Organisations Help Us Help Them And Make A Difference In A Child In 2020 Child Protection Virtual Hug Long Term Care Insurance

Tekkie Tax Benefits 32 Child Protection Organisations Help Us Help Them And Make A Difference In A Child In 2020 Child Protection Virtual Hug Long Term Care Insurance

Why E Verify Itr Verification Online Income Tax Income Tax Return Tax Return

Why E Verify Itr Verification Online Income Tax Income Tax Return Tax Return